How to get Your CRB (Credit Reference Bureaus) Clearance Certificate

A Credit Reference Bureau (CRB) is a company that keeps track of your credit rating so that potential lenders (Banks, Sacco’s, Microfinance firms, etc.) can assess your suitability for borrowing all the while keeping a record of defaulters.

However nowadays employers too, particularly the national and county governments, are increasingly making it a requirement for job applicants to show their credit status as part of the job application process. To do this one is required to get a CRB clearance certificate that has to be obtained from a licensed CRB company.

At the time of this writing, the Central Bank of Kenya has licensed three CRB firms that include:

- TransUnion Africa (Credit Reference Bureau Africa Limited

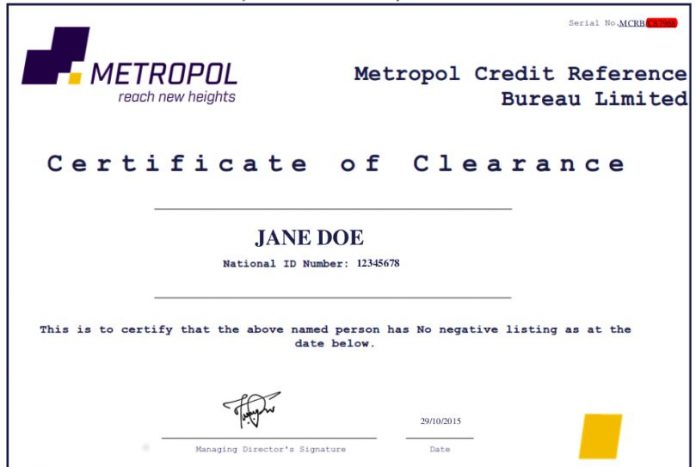

- Metropol Credit Reference Bureau Limited

- Creditinfo Credit Reference Bureau Kenya Limited

You can get your CRB clearance certificate from any of these three companies, and while the fee is similar across all of them there are some subtle differences in the exact procedure.

What You’ll Need

- KSh.2200 fee to request the clearance certificate (this absurdly high fee is unfortunately constant across all three CRBs)

- KSh.50 for Registration

- M-PESA, Airtel Money or Equitel to pay the above fees

- TransUnion Nipashe App

- Android Phone to install the app

- A valid Email Address

How to get Your CRB (Credit Reference Bureaus) Clearance Certificate

STEPS

1. Download and install the latest TransUnion Nipashe app from Google Play store.

2. Launch the app and fill your personal details that include your names, National ID Number and mobile phone number (for convenience use the one you intend to pay with). Tap the Next button to continue.

3. The app will now automatically check your credit rating and report it on the Welcome page. However, to access the other services you’ll need to activate your account first. Tap the Activate button at the bottom of the page to do this.

4. You’ll be quickly prompted to register as part of this activation. To do this pay, the aforementioned KSh.50 to the Safaricom paybill number 212121with your ID number as the account number. If you use Equitel, you can pay the fee using the paybill number 212120 with your ID number likewise serving as the account number.

5. Once the payment of the Ksh.50 is completed, you’ll get an SMS from TransUnion (TRANS-CRB) with a verification code and a confirmation that the registration was successful. Also, you’ll be now receiving a free credit report yearly.

6. Go back to the Nipashe App and enter this verification code and tap the Verify button to complete the activation. The other services will now be accessible.

7. Now just swipe to the Clearance Certificate page and enter the email address where you’d wish to receive the certificate then tap on the Submit button.

8. You’ll now be prompted to pay the KSh.2200 to the M-PESA/Airtel Money paybill 212121 using the mobile number you registered/activated your TransUnion app with. When paying, use your ID Number as the account number.

9. Once you pay, you’ll get an SMS from TransUnion confirming that a clearance certificate has been sent to your email address.

Check your email address and download the certificate which will have been sent in PDF.

Do you have any news or article you would like us to publish? Kindly reach us via outreach@t4d.co.ke or howtodoafrica@gmail.com.