List of all international banks in Kenya

An international bank is a bank that offers financial services across geopolitical borders.

Also referred to as offshore/foreign banking, it draws customers from different locations across the globe for a specific range of services.

There is a large concentration of international banks in Kenya.

While some operate as subsidiaries of larger multinational financial institutions, some are local banks that have gone international.

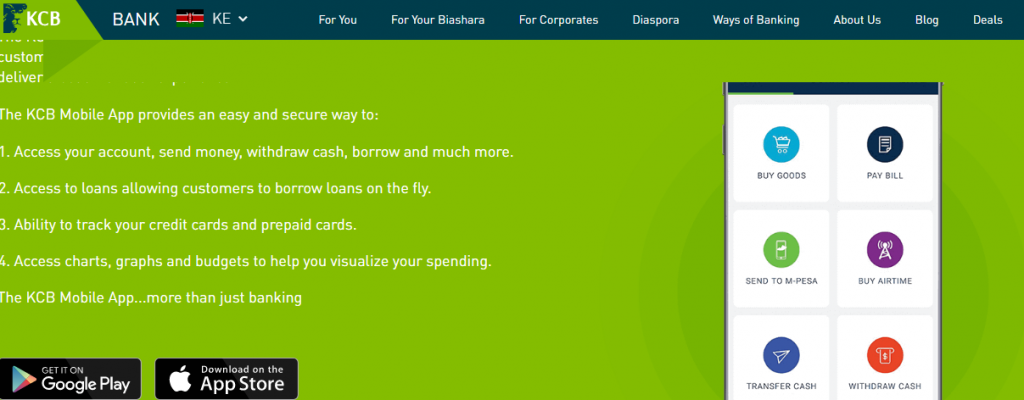

1. Kenya Commercial Bank (KCB)

-

- KCB is registered as a commercial bank by Kenya’s regulator Central Bank of Kenya (CBK).

- The bank boasts a Ksh. 939.6 billion asset base and a reach of 205 branches countrywide.

- It has since crossed over Kenya’s borders with operations in Uganda, Tanzania, South Sudan, and Burundi.

- Kenya Commercial Bank also has over 29 million Kenyan customers, as well as 26,726 agents countrywide.

- Alongside other top banks, KCB controls close to half of Kenya’s market share.

- KCB provides distinct services for both individual and corporate utility.

- The services include;

-

- Loans

- Insurance

- Savings

- Financing

-

- Its popular KCB-MPESA service has enabled millions of users to save and borrow loans from it.

- KCB has also digitized its services and is now accessible on the world wide web and KCB Applications.

- Click here to download the KCB Android mobile App.

- Click here to download the KCB iOS mobile App.

Also read: List of all tier 1 banks in Kenya

2. Equity Bank Kenya

-

- Equity Bank Kenya Limited is a financial services provider headquartered in Nairobi, Kenya.

- It is licensed as a commercial bank by the Central Bank of Kenya which is Kenya’s banking regulator.

- Equity Group Holdings, its parent company, has subsidiaries in the following other countries in Africa;

-

- Uganda

- Tanzania

- Rwanda

- South Sudan

- The Democratic Republic of Congo

- A representative office in Ethiopia

-

- Alongside other top banks, Equity controls close to half of Kenya’s market share.

- Equity is also the most accessible bank in Kenya complete with Mtaani agents as well as User SIM cards.

- Mimicking Safaricom’s M-PESA, Equity Bank customers can perform deposits, withdrawals, and a host of other transactions using the convenient Equitel line.

- After being introduced in 2014, Equity Bank’s mobile network Equitel attracted more than 2.7 million users in just 2 years.

- This cutting-edge banking maneuver grew Equity Bank’s market share to 20%.

- By 2021, Equity Bank had an asset base of over Ksh. 1.12 trillion.

- Equity Bank has also digitized its services and is now accessible on the world wide web and Equity Bank Applications.

- Click here to access the online Equity Bank self-service portal.

- Click here to download the Equity Bank Mobile App.

3. Standard Chartered Kenya (Stanchart Kenya)

-

- Standard Chartered PLC is a British multinational bank that offers retail banking in Kenya.

- Standard Chartered Bank Kenya Limited is regulated by the Central Bank of Kenya.

- The bank offers individual consumer, corporate, institutional banking, and treasury services.

- Its first branch in Kenya was opened at Treasury Square in Mombasa’s Central Business District.

- The bank has also been on a recent winning streak of banking awards, having won accolades including;

-

- World’s Best Trade Finance Provider in Kenya 2022

- Best Trade Finance Bank in East Africa 2022

- Best Consumer Digital Bank 2020

-

- Standard Chartered Bank Kenya has also digitized its services and is now accessible on the world wide web and Standard Chartered Bank Applications.

- Click here to download the Stanchart Kenya mobile App.

4. Stanbic Bank

-

- Stanbic Holdings Plc, formerly known as CfC Stanbic Holdings Limited, is a financial services organization in Kenya.

- Headquartered in Nairobi Kenya, Stanbic Bank has subsidiaries in Kenya and South Sudan.

- Alongside other top banks, Stanbic controls close to half of Kenya’s market share.

- The bank has been serving Kenyans since 1958, with a wide range of products including;

-

- Private banking

- Diaspora banking

- Construction Financing

- Salary or cash advance

- Loans including home loans

- Mobile banking

-

- Click here to download the Stanbic Bank Mobile App.

5. Absa Bank Kenya

-

- Absa Bank Kenya PLC, formerly Barclays Bank Kenya Limited, is a commercial bank registered in Kenya.

- The bank is a subsidiary of the South Africa-based Absa Group Limited.

- It is licensed by the Central Bank of Kenya, the central bank and national banking regulator.

- Absa Bank is present in 12 countries offering financial services including;

-

- Personal Banking

- Islamic banking

- Corporate investment

- Insurance

- Asset management

-

- Absa has a popular money lending service Timiza that is ideal for low-income earners.

- The service is accessible through both USSD and online mobile Apps.

- Click here to download the Absa Bank Mobile App.

- Click here to download the Absa Bank iOS Mobile App.

Also read: List of All Taxi Hailing Apps in Kenya

6. Diamond Trust Bank Group (DTB)

-

- Diamond Trust Bank Group is a Kenyan bank that was founded in 1945.

- The bank has enjoyed decades of growth that has seen it begin operations in the following countries;

-

- Burundi

- Tanzania

- Uganda

-

- DTB is majority owned by the Aga Khan Fund for Economic Development.

- Headquartered along Nairobi’s Mombasa Road the bank deals with both corporate and individual clients.

- The bank has also been registered by the Nairobi Securities Exchange since 1972.

- Diamond Trust Bank offers the following services;

-

- Fixed deposits

- Salary Accounts

- Diaspora banking

- Mortgage

- Leasing

- Insurance premium financing

- Overdraft facilities

- Term loans

-

- Click here to download the Diamond Trust Bank Android Mobile App.

- Click here to download the Diamond Trust Bank iOS Mobile App.

7. Bank of India

-

- The Bank of India is a foreign financial service provider that is based in Bandra Kurla Complex, Mumbai.

- The bank has been operating in Kenya since 1953 when it opened its first branch in Mombasa.

- A Nairobi branch was opened in 1954. The Bank has also been modifying its corporate identity over the years to maintain the spirit of modernization.

- The colors of Bank Of India’s Star have changed colors to Blue, Russet, and Ochre, which has enhanced the visual appeal of the logo.

- Registered as a commercial bank by the Central Bank of Kenya, it offers the following services;

-

- Loans and advances

- Safe deposit

- Savings account

- Fixed deposit account

- Current account

-

8. Bank of Baroda

-

- Bank of Baroda is a central public sector bank under the ownership of the Ministry of Finance, Government of India.

- The bank is headquartered in Vadodara, Gujarat in India.

- The parent Bank has an International presence in 94 overseas offices spanning 17 countries including Kenya.

- Registered as a commercial bank in Kenya, the Bank of Baroda provides both personal and corporate banking services.

- It has a mobile banking platform, Baroda Mobi Kenya which is an App on the Google Play Store.

- Click here to download the Baroda Mobi Kenya App on Google Play Store.

9. Ecobank

-

- Ecobank, whose official name is Ecobank Transnational Inc., is a pan-African banking conglomerate.

- The bank has banking operations in 33 African countries.

- Ecobank Transnational is the leading independent regional banking group in West Africa and Central Africa, serving wholesale and retail customers.

- Ecobank Kenya (EKE) had an asset base of Ksh. 94.4 billion as of 31st December 2020.

- The bank currently has 16 branches, 29 ATMs, and over 40 Xpress Point Agents located in different parts of Kenya.

- Ecobank Kenya offers individual consumer banking, corporate, and investment banking.

- Click here to download the Ecobank Kenya App on Google Play Store.

10. I&M Bank Kenya

-

- I&M Bank Kenya Limited is a commercial bank based in Kenya, the largest economy in the East African Community.

- I&M Bank is licensed by the Central Bank of Kenya which is Kenya’s banking regulator.

- I&M Bank has operations in the following countries through its susidiaries;

-

- Rwanda

- Tanzania

- Uganda

- Mauritius

-

- It was incorporated on 16th August 1950 and is one of the oldest companies to list on the Nairobi Securities Exchange (NSE).

- The bank currently has an asset base of Ksh. 429 billion and offers the following services in its 83 branches countrywide;

-

-

- Individual banking

- Corporate banking

- Insurance services

- Loans and advances

-

-

- Click here to download the I&M Bank Kenya App on Google Play Store.

11. SBM Bank Kenya

-

- SBM Bank Limited, previously known as Fidelity Commercial Bank Limited is a commercial bank in Kenya.

- Fidelity Commercial Bank Kenya was in 2017 purchased and became a subsidiary of SBM.

- The State Bank of Mauritius (SBM) consequently renamed it and became SBM Kenya Bank.

- SBM Bank Kenya offers the following services to its customers;

-

-

- Individual banking

- Corporate banking

- Diaspora banking

- Loans

- Salary accounts and payday advances

- Asset Insurance

-

-

- Click here to download the SBM Bank Kenya Android App on Google Play Store.

- Click here to download the SBM Bank Kenya iOS App.

12. Co-operative Bank of Kenya

-

- Co-operative Bank of Kenya is a registered commercial bank in Kenya, the largest economy in the East African Community.

- It is licensed by the Central Bank of Kenya which is the national banking regulator.

- The bank was listed on December 22nd, 2008 using collective shares of 3,805 Co-operative Societies and unions.

- Co-op has a subsidiary, Kingdom Securities Limited which is a stockbroking firm. The bank owns 64.56% of Kingdom Securities.

- Another subsidiary, the Co-operative Bank of South Sudan Ltd offers banking services in the Republic of South Sudan.

- Co-operative Bank offers a wide array of financial services including;

-

- Banking for businesses

- Individual banking

- Banking for co-operatives

- Banking for Institutions

- Investor services

-

- Co-op Bank has also digitized its services and is now accessible on the world wide web and mobile banking.

- Click here to download the Co-operative Bank mobile App.

13. NCBA Bank

-

- NCBA is a major player in Kenya’s banking sector.

- It was formed in a highly publicized 2019 merger between heavyweights NIC Bank and the Commercial Bank of Africa (CBA).

- Headquartered in Nairobi Kenya, NCBA Bank has subsidiaries in the following countries;

-

- Uganda

- Tanzania

- Rwanda

- The Ivory Coast

-

- The NCBA Bank Kenya offers a wide range of financial services including;

-

- Current and savings accounts

- Diaspora banking

- Forex solutions

- Home and plot loans

- Asset finance (car and logbook loans)

- Personal loans

- Overdrafts

- Insurance services for cars, homes, health, critical illness, and personal accident, among others.

- Investment services

-

- Alongside other top banks, NCBA Bank controls close to half of Kenya’s market share.

- NCBA offers cutting mobile banking options to its customers featuring a functional online self-service portal and mobile Apps.

- Click here to download the NCBA Kenya Android App on Google Play Store.

- Click here to download the NCBA Bank Kenya iOS App.

14. Guaranty Trust Bank

-

- Guaranty Trust Bank (Kenya) Ltd, commonly referred to as GTBank Kenya, is a registered commercial bank in Kenya.

- This is a subsidiary of the n Guaranty Trust Bank PLC which is based in Nigeria.

- The Nigerian bank is a tier 2 bank in Kenya that offers a wide range of services to its customers.

- Apart from Kenya, the bank has operations in the following countries;

-

- Uganda

- Rwanda

- South Africa

-

- Guaranty Trust Bank (Kenya) Ltd offers the following services;

-

- Commercial and corporate banking

- Personal Banking

- SME banking

-

- Click here to download the Guaranty Trust Bank Android App on Google Play Store.

15. Citibank Kenya

-

- Citibank is an American bank that has operated in Kenya since 1974 with its main branches located in Nairobi and Mombasa.

- Citibank Kenya serves as a regional hub of the Citi East Africa cluster which includes Kenya, Uganda, Tanzania, and Zambia.

- Unlike many commercial banks in Kenya that serve both individuals and corporate customers, Citibank only serves corporate and institutional clients.

- Citibank was founded in 1812 as the City Bank of New York and it is headquartered in New York City, USA.

- Click here to access the Citibank Kenya online banking platform.

16. ABC Bank

-

- ABC Bank is the African Banking Corporation Limited, a Kenyan commercial bank established in 1984.

- The bank is headquartered in the Westlands area of Nairobi and jointly holds 10% of the market share with the rest of the tier 3 banks.

- ABC Bank has 15 branches across Kenya and Uganda (11 in Kenya) where it offers the following services;

-

-

- Business Banking

- Personal Banking

- Stock brokerage

- Investment advisory

- Insurance

- Risk management

-

-

- The bank began as Consolidated Finance Company, a Nairobi-based lending institution.

- It has enjoyed steady growth that saw it amass over 50,000 clients across its 4 decades of existence.

- ABC Bank had an asset base of over Ksh. 36 billion by the end of 2022.

- ABC Bank also has a mobile banking platform to make your experience easier.

- Click here to download the ABC Bank Android mobile App.

17. UBA Bank

-

- United Bank for Africa PLC is a Multinational pan-African financial services group headquartered in Lagos Nigeria.

- Also known as Africa’s Global Bank, it has subsidiaries in 20 African countries, as well as offices in London, Paris, and New York.

- The Kenyan subsidiary of UBA Bank is a decent licensed financial institution that offers the following services;

-

-

- Cards. Cards are highly convenient and can facilitate various transactions without you visiting the bank.

- Personal banking that includes current and savings accounts

-

-

- Click here to download the UBA Bank Android mobile App.

18. Habib Bank AG Zurich

-

- Habib Bank AG Zurich is a Swiss multinational commercial bank which is based in Zurich, Switzerland.

- The bank has subsidiaries operating in Kenya and the following other countries;

-

- Pakistan

- South Africa

- The United Arab Emirates

- The United Kingdom

-

- Habib Bank AG Zurich offers the following services;

-

- Individual Banking

- SME Banking

- Corporate Banking

- Institutional Banking

-

- Click here to download the Habib Bank AG Zurich Kenyan mobile App.